Impact Report 2025

The Colorado you love is shaped by CU donors.

From across the state and around the world, CU donors help bring what you love about Colorado to life.

Donors gave $522.4 million across CU’s four campuses in fiscal year 2025—their second-highest giving total ever. More than 46,000 donors made nearly 79,000 gifts, averaging $1.4 million per day.

Discover the generosity powering what you love.

Every gift, of any size, makes a difference.

$63 million to support students with scholarships and fellowships

Who gave to CU last year?

Alumni

Parents

Faculty & Staff

Friends

Corporations & Foundations

Other

The power of giving through wills and bequests

Last year, generous individuals chose to support CU’s future by including the university in their wills or estate plans, resulting in more than $128 million in planned gifts.

These contributions will create scholarships, advance research, support programs and establish new endowed chairs and professorships across all four CU campuses.

Endowment Update

$2.5 billion endowment value

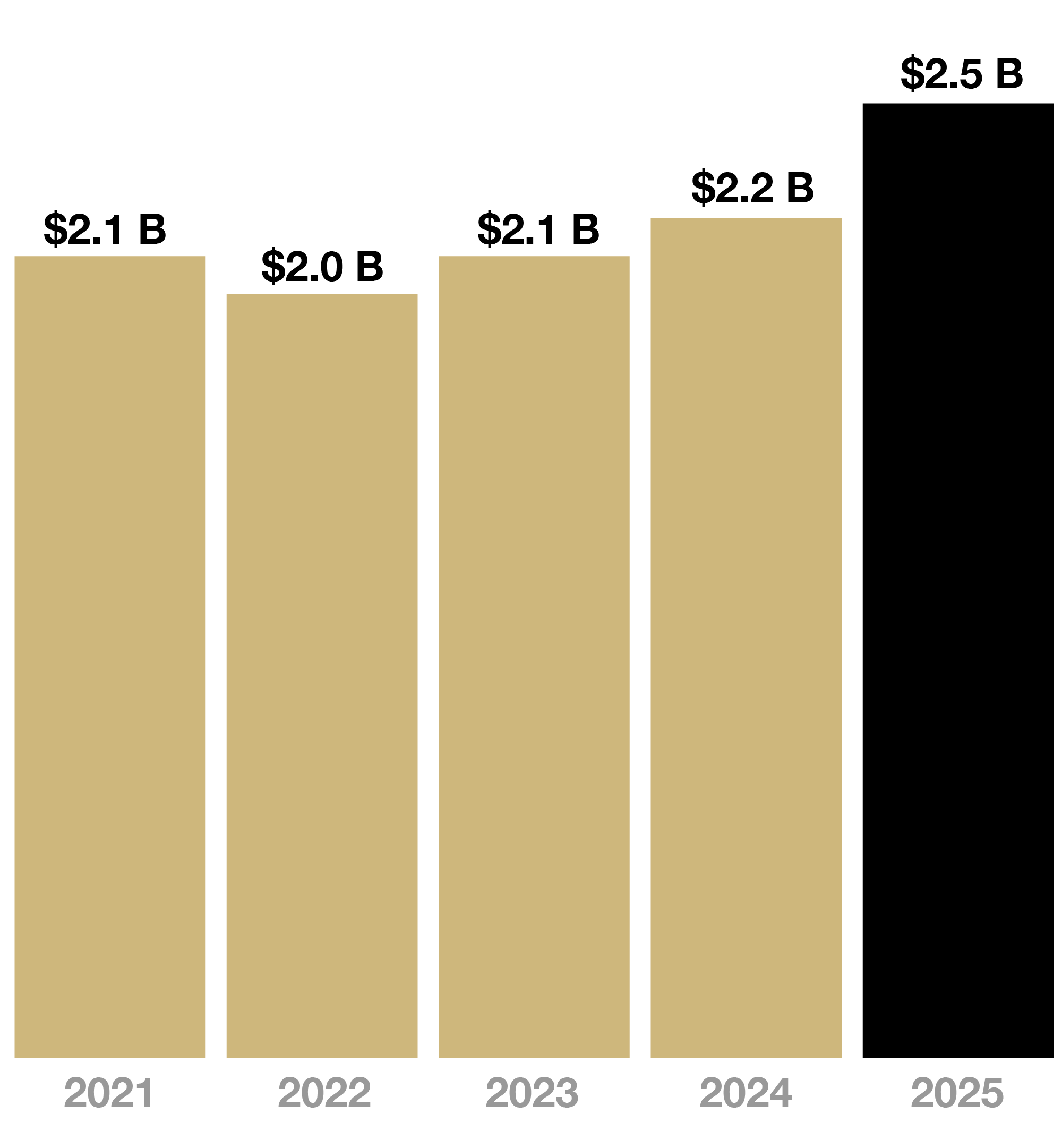

CU’s endowment was valued at $2.5 billion to end fiscal year 2025. Here are the endowment’s values in recent years. (Values are in billions as of June 30 each year.)

How the endowment is invested

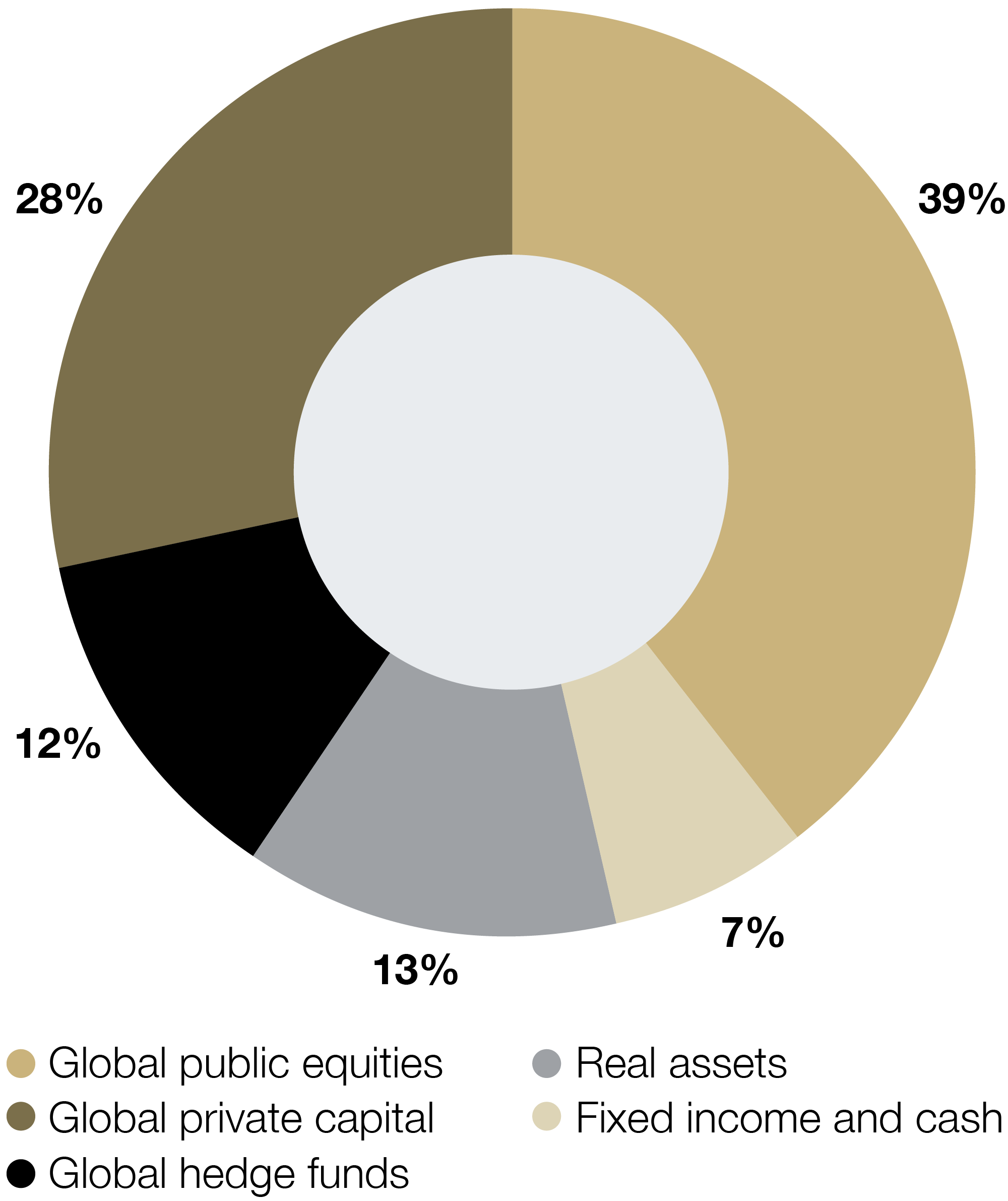

The endowment is invested in the Long Term Investment Pool, or LTIP, which is broadly diversified across asset classes with a long-term, strategic investment horizon in mind. Here’s how the LTIP was invested in fiscal year 2025.

CU investment performance

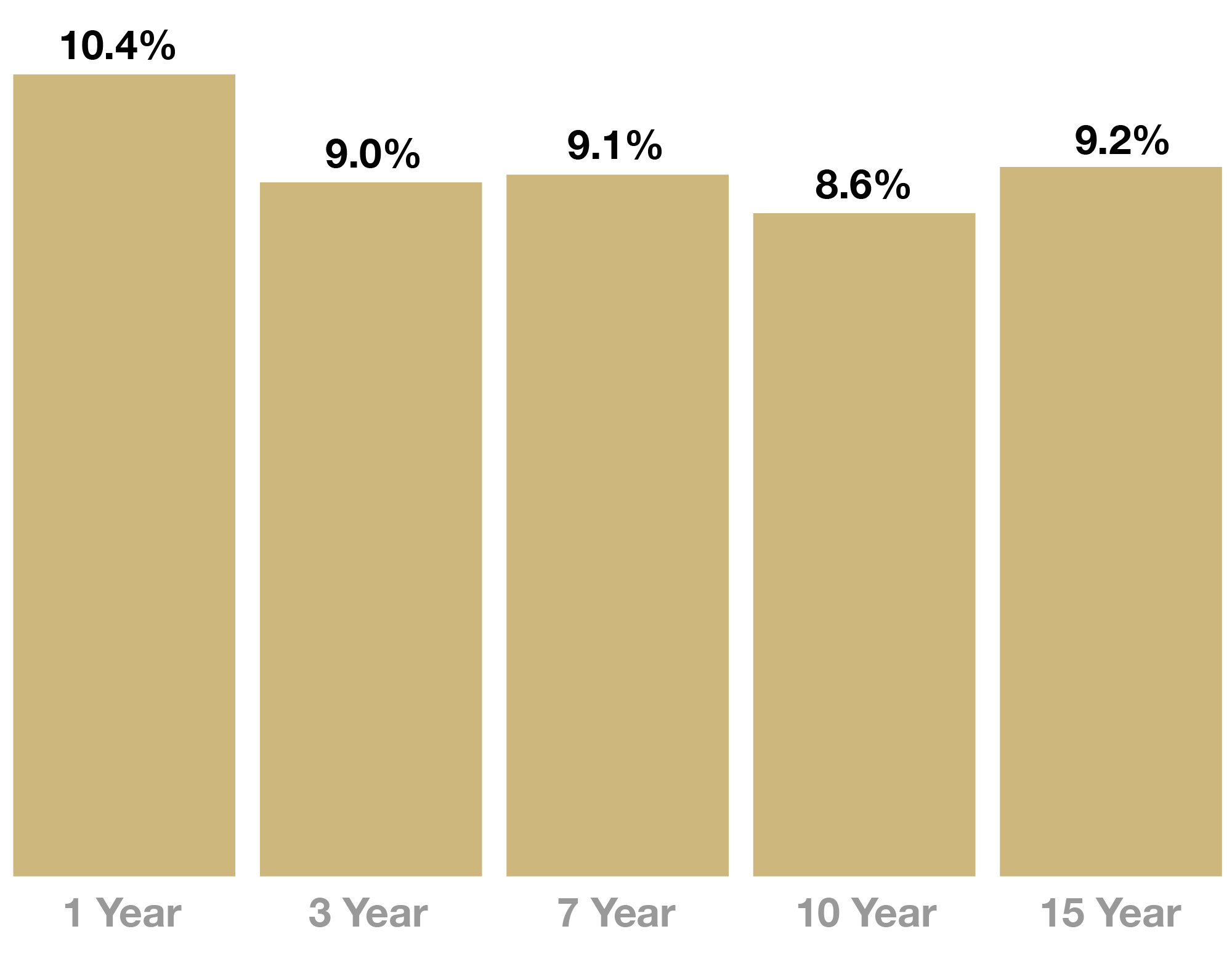

Here is the LTIP’s investment performance over the past 15 years. As of June 30, 2025, the LTIP’s 1-year annualized investment performance was +10.4%, its 3-year performance was 9.0%, its 7-year performance was +9.1%, its 10-year performance was +8.6%, and its 15-year performance was +9.2%. These returns were achieved with approximately 33% less risk than a portfolio invested exclusively in public equities.

Transfers from the CU Foundation to the university

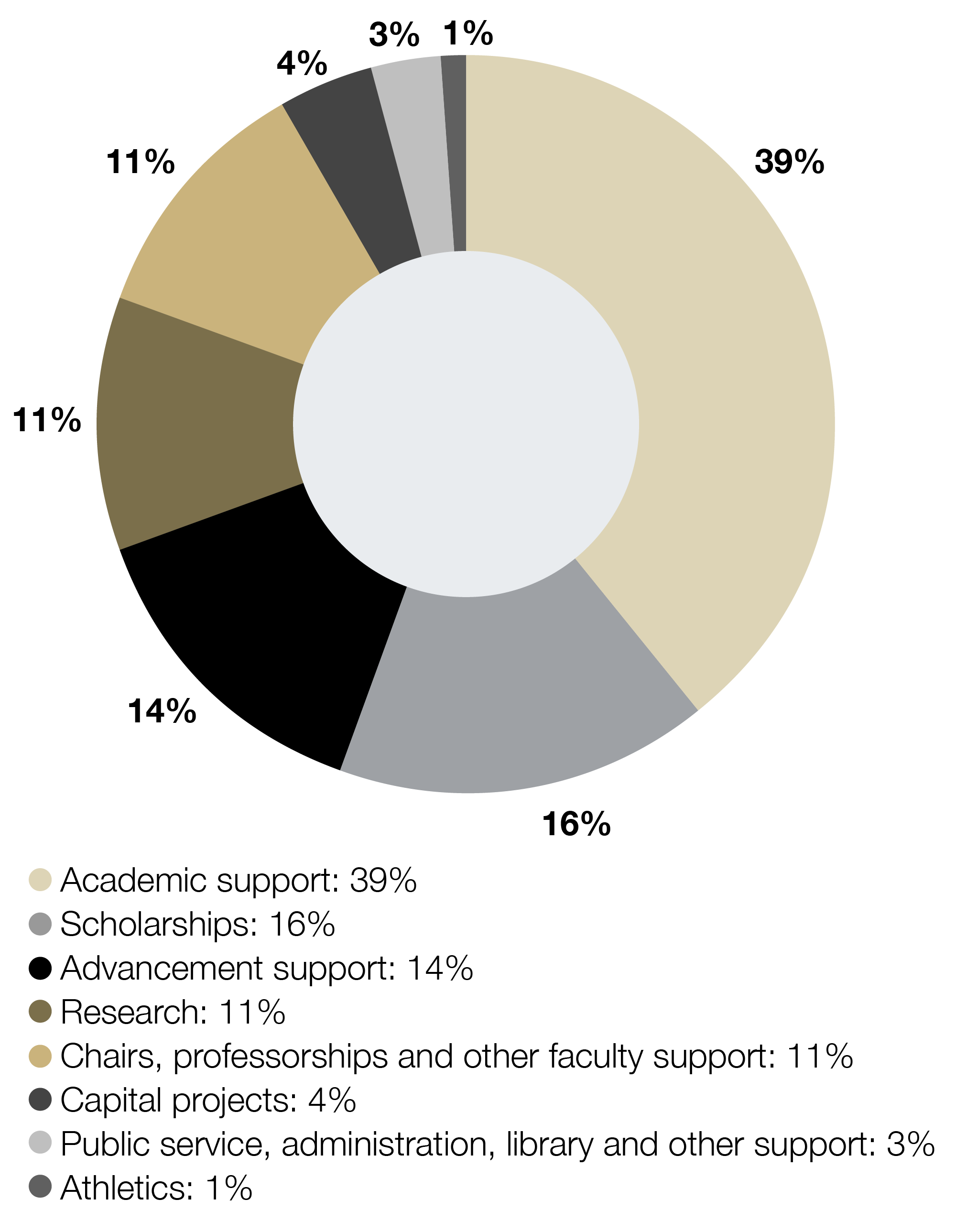

$269 million was transferred to the University of Colorado from the CU Foundation in fiscal year 2025. Here's how that amount was allocated to various areas of our institutions.

Download our audited financials

Find out more about philanthropic investments in CU by downloading our audited financials for fiscal year 2025.